Characteristics and Performance of Large-Cap Growth Stocks

One of the prominent characteristics of large-cap growth stocks is their notable market capitalization. They typically have a market cap exceeding $10 billion, representing a significant portion of the total market valuation. With the scale that these large-cap stocks possess, they are often recognized as reliable and stable contributors to various investment portfolios. These heavyweight market players are often the marquee names in the business world, with a history of strong performance, healthy financial standings, and robust operations.

Furthermore, these large-cap growth companies possess a remarkable ability to generate considerable profits. Their years or even decades in business provide them with a wealth of experience, understanding, and well-established operations, facilitating consistent growth. They continually outpace the average rate of corporate growth, leading to impressive returns on investment regularly.

Large-cap growth stocks also provide an attractive prospect for investors due to the combination of consistent growth and competitive advantage. They often operate in industries with high barriers to entry, creating a cushion for their market position. Moreover, these companies usually have robust research and development departments, focusing on innovation and new product development, securing their competitive edge and fueling their consistent growth.

Large-cap growth stocks have also shown their resilience during uncertain times. In times of an economic downturn, they tend to outperform their smaller peers. This is primarily due to their financial strength, diverse operations, and capacity to absorb shocks, making them less susceptible to market fluctuations.

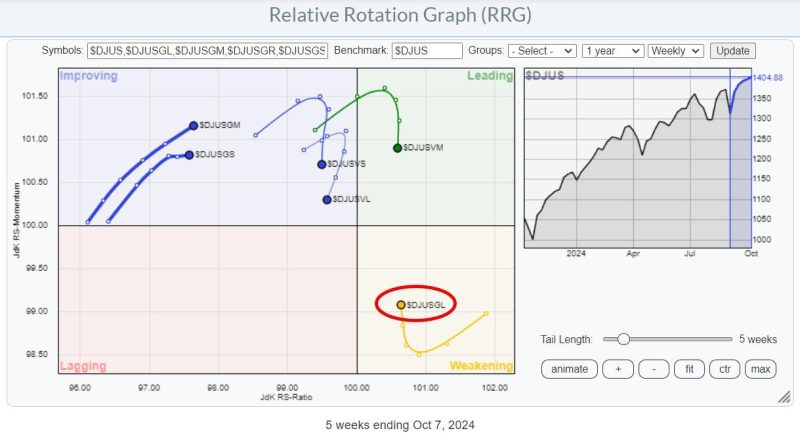

Trends and Impact of Large-Cap Growth Stocks (Mag 7)

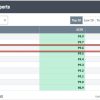

The Magnificent Seven (Mag 7), a term that refers to large-cap growth stocks such as Amazon, Apple, Microsoft, Alphabet, Tesla, Facebook, and Nvidia, have had a noteworthy impact on the stock market. The remarkable success of these seven technology titans has reshaped the investment landscape, underlining the importance of large-cap growth stocks.

These tech giants dominate the landscape not only in terms of their market capitalization but also in the power they wield over their respective industries. Their flourishing businesses have been backed by strong financials, continuous innovation, and immense popularity among consumers, providing a strong growth narrative.

The predominance of these tech giants underlines the potential lopsidedness of the market, a byproduct of their unrelenting growth. Their hegemony also poses a question about diversification: is it prudent for investors to put a significant chunk of their investments in these seven companies? While dissociating from these stocks carries the